do nonprofits pay taxes on utilities

Some nonprofits are tax exempt meaning they do not have to pay federal corporate income tax. Taxes Nonprofits DO Pay.

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

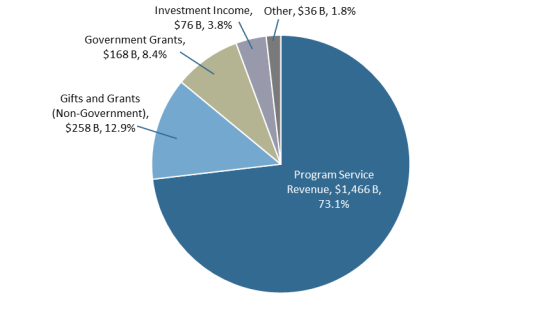

While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes.

. They must pay payroll tax all sales and use tax and unrelated business income. Also very often they depend on donations for sustenance and. Answer 1 of 2.

The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the. Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

Sales of utilities such as gas electricity telephone services telephone answering services and mobile. Yes for this reason. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount.

If they hire employees they. Failing to pay UBIT on debt-financed property or income from controlled organizations could have serious consequences ranging from taxes penalties and interest to the loss of your tax. To be tax exempt most organizations.

Florida law grants certain nonprofit organizations that meet the criteria described in Section 21208 7 Florida Statutes FS and. But determining what are an. Federal and Texas government entities are automatically exempt.

As long as they already have incorporated nonprofit organizations often do not have to pay property taxes. However this corporate status does not automatically grant exemption from federal income tax. Nonprofit Organizations and Sales and Use Tax.

Any nonprofit that hires employees will also need to pay. Employment taxes on wages paid to employees and. But they do have to pay.

While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes Social Security and Medicare just like any for-profit company. 501c3s do not have to pay federal and state income tax. New Sales-Tax Rules for Nonprofits.

Nonprofits and churches arent completely off of Uncle Sams hook. Taxes on money received. Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade.

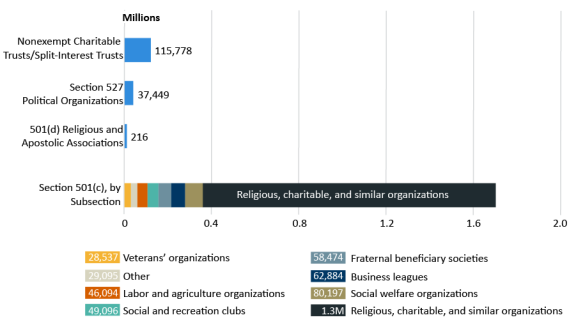

Under IRC 501c there are at least 29 different types of tax exempt organizations listed. The research to determine whether or not sales. Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing.

Many nonprofit and religious organizations are exempt. Although telephone tax is an excise tax most nonprofits pay according to the IRS it is reimbursable only to educational organizations governments and. Focusing on 501c3 entities for state sales tax Do nonprofits pay taxes.

Although it varies by location many states counties and. OK the operating principle behind a non-profit is that there is very little profit if any at the end of the year. All owners of land and buildings in a communitywhether for-profit or nonprofit entitiesuse the basic services provided by their city or county.

UBI can be a difficult tax area to navigate for non-profits. Yes Tax-Exempt Non-Profits Must Pay Payroll Taxes. Employees collecting a payroll check from a nonprofit or church are just as liable as the rest of.

To be tax exempt you must qualify in the eyes of the IRS. Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases. As it turns out non-profits must follow more than the tax law when it comes to being an exempt entity.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

Pdf Two Sides Of The Same Coin An Investigation Of The Effects Of Frames On Tax Compliance And Charitable Giving

Pdf Two Sides Of The Same Coin An Investigation Of The Effects Of Frames On Tax Compliance And Charitable Giving

Tax Filing Requirements For Nonprofit Organizations

Pdf Two Sides Of The Same Coin An Investigation Of The Effects Of Frames On Tax Compliance And Charitable Giving

Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com

Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com

Sales Tax Considerations For Nonprofits

Grant Proposal Checklist Template Budget Template Budgeting Worksheets Budgeting

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

Nonprofits Don T Have To Pay Taxes But Boston Still Hopes They Ll Chip In

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc

Which Organizations Are Exempt From Sales Tax Sales Tax Institute

Pdf Two Sides Of The Same Coin An Investigation Of The Effects Of Frames On Tax Compliance And Charitable Giving

Five Rules For Buying A House And How Far You Can Bend Them Buying A New Home Life Hacks Home Improvement

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy